Do you have following questions regarding VAT?

- Who is exempt from VAT in UAE?

- What is the VAT rate in UAE?

- What is zero rated VAT?

- Do I have to register for VAT if my supplies are zero rated?

- Which services are VAT exempt?

- What conditions qualify for VAT exemption in UAE?

- How is VAT calculated in UAE?

- What is VAT registration exception certificate in UAE?

- Do I have to register for VAT in UAE if my supplies are exempt?

- What is the difference between exempt and zero rated supplies?

Look no further we will explain all that is required for you to know about VAT registration in UAE.

Do business charge VAT on zero rates or exempt supplies in UAE?

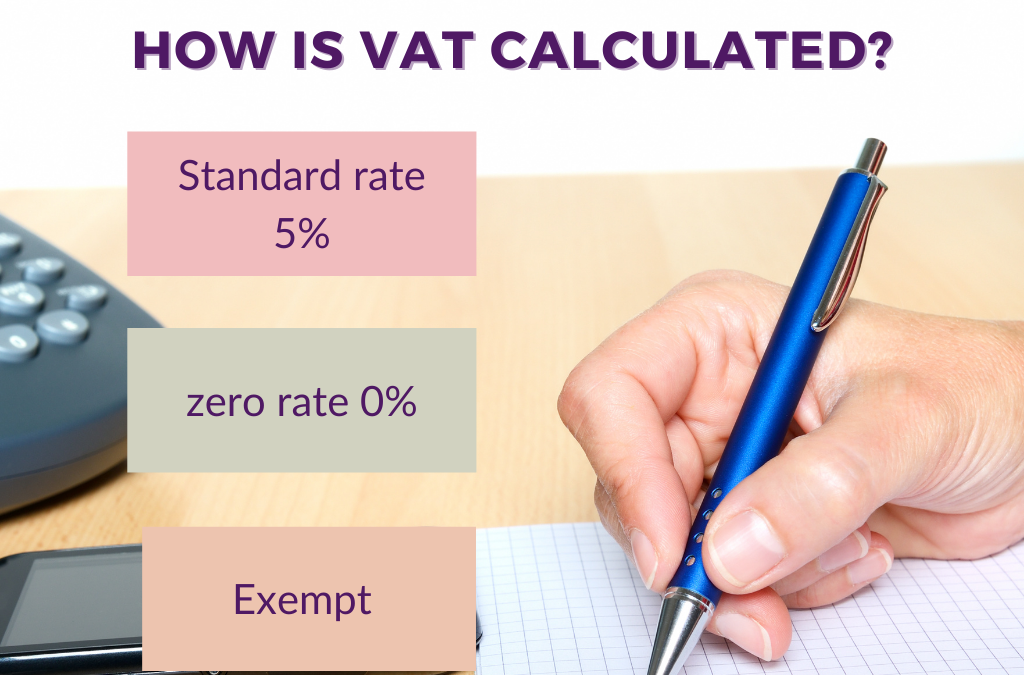

- VAT since its implementation in 2018 is a legal obligation on meeting certain criteria set by Federal decree law (8) of 2017 and regulated by Federal tax Authority (FTA ) in united arab emirates (UAE) at the standard rate of 5%.

- 5% VAT rate is called standard rate. The other two categories of supplies which differ from standard rate of 5 % VAT are exempt supplies and zero rated supplies.

Difference between zero rated and exempt supplies in UAE.

Zero-rated supplies are included while calculating registration threshold whereas tax exempt supplies don’t count.You can claim refund for input VAT related to zero-rated supplies. However, you cannot claim back the VAT input you paid to provide tax exempt supplies.

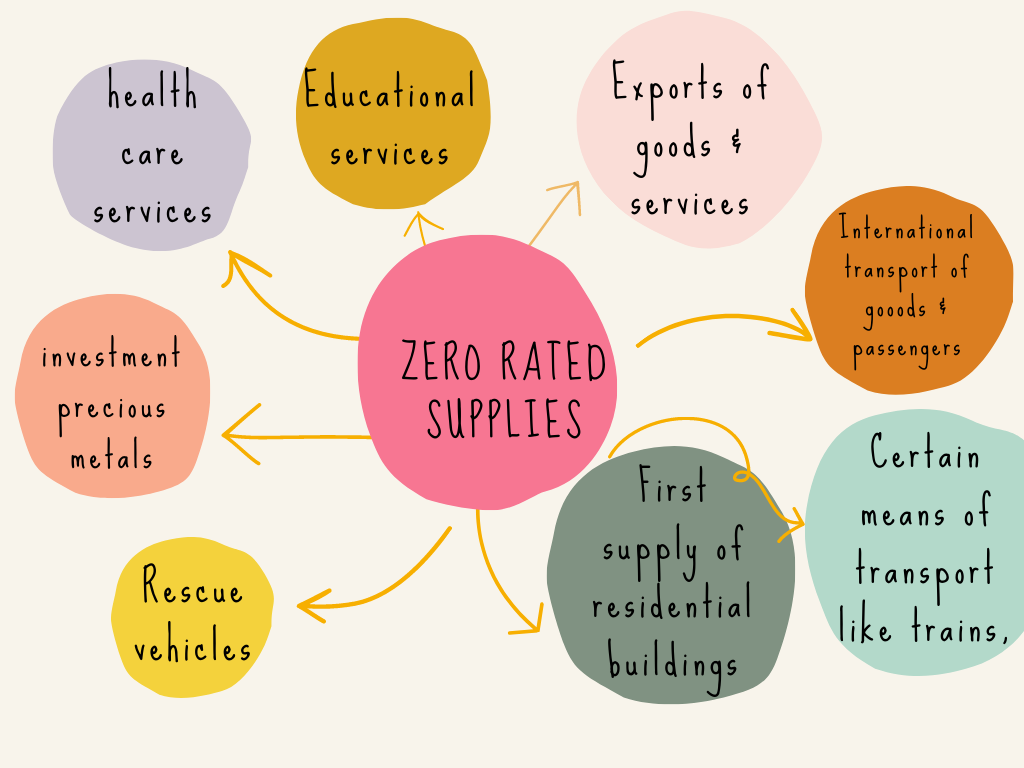

Zero rated supplies

- Supplies subject to zero percent rate are zero rated supplies and are listed in Article 45 of the Federal Decree-Law no. (8) of 2017 on VAT.

- Zero rated supplies are allowed to claim input tax if they are registered with FTA.

- If your business is only making zero rated supplies you can apply for exception certificate from FTA.

- If exception from registration is granted, then you will not submit regular tax returns and you will not be able to recover input tax incurred.

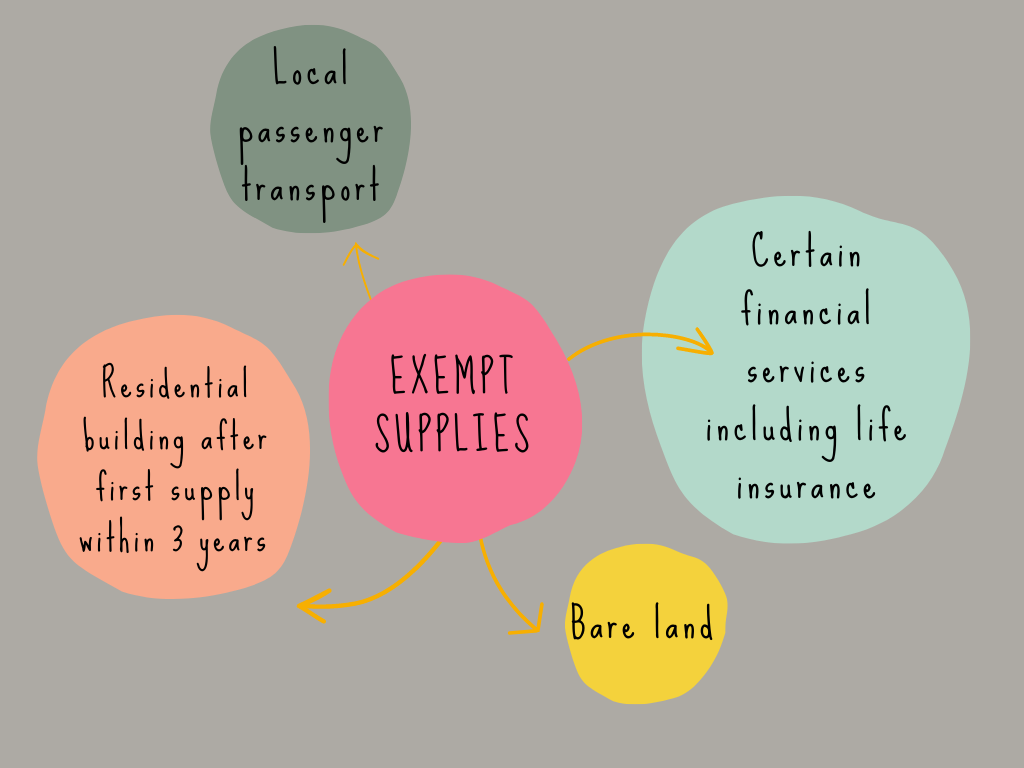

Exempt supplies

- Exempt supplies are not taxable supplies for VAT purposes.

- VAT is not charged on exempt supplies and the supplier cannot recover any VAT on expenses incurred in making those exempt supplies.

- If all the supplies you make are exempt, you do not have to register for VAT. In such a case, you cannot recover tax incurred on business purchases (input VAT).