Overview

Businesses registered with Federal tax Authority (FTA) in UAE must file VAT returns on a regular basis within 28 days of the end of the tax period that is defined for each type of business on registration.

Online portal to file VAT return

- The VAT return filing process in UAE is entirely online.

- The VAT Return is in the form of VAT 201 is available to each FTA registered login and it consists of three main sections other than your business detail and period of return as follows;

• VAT on sales and all other outputs

• VAT on expenses and all other inputs

• Net VAT Due

• Declaration and Authorized Signatory - You must submit a VAT Return even if you have no VAT to pay or reclaim.

Process of Filing VAT Return in UAE – VAT Return Form 201

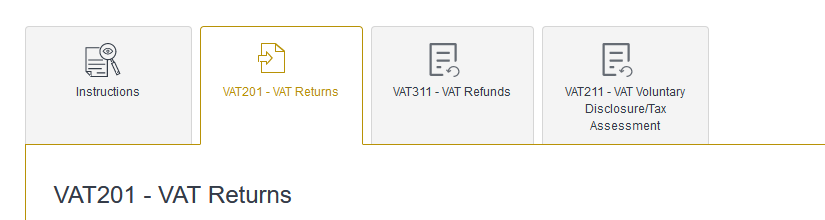

Upon registration you will get log in credentials to open your account on FTA online portal. Once you are logged in you will find a section named as VAT, click on to that and you will find VAT form as follows;

VAT 201- New VAT Return when you select this form you can access the detail on this form in sections. You will see following sections in addition to Taxable person details, VAT retrun period sections.

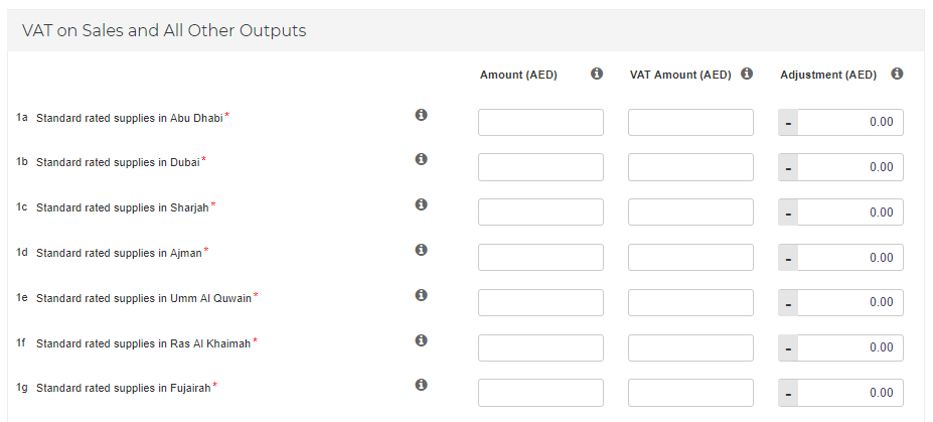

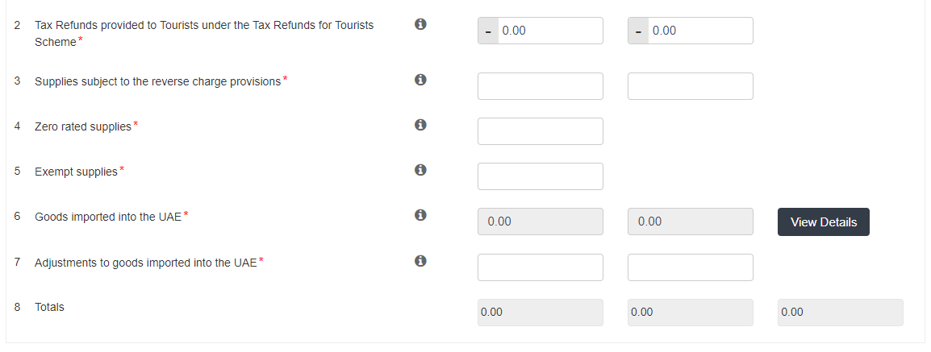

VAT on sales and all other outputs

In this section you are required to fill in the details of standard rate taxable supplies at the Emirates level, zero rated supplies, exempt supplies, supplies subject to reverse charge mechanism etc.

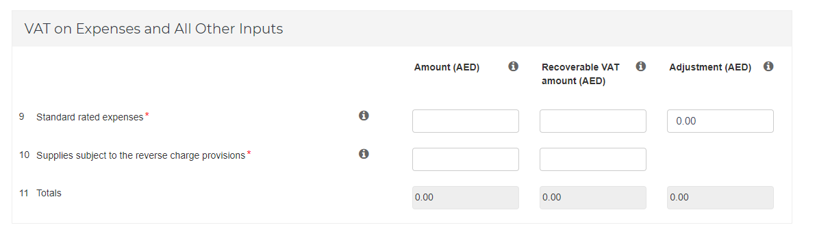

VAT on Expenses and All other Inputs犀利士

In this section, you need to file the details of purchases and expenses on which you have paid VAT at a standard rate of 5% and supplies subject to reverse charge basis as follows

Net VAT Due

This section indicates your VAT payable or refundable based on the information provided in the sales and expenses section of VAT return form 201.

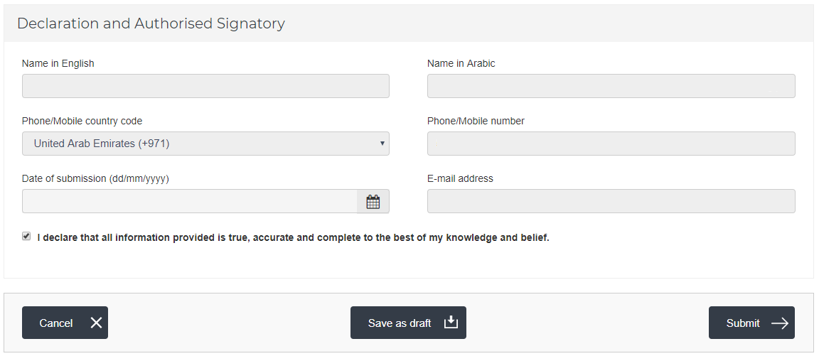

Declaration and Authorized Signatory

In this section check the authorized signatory details and tick the box next to the declaration section to submit the VAT Return.

Before submitting the VAT Return, make sure every information is correct and up to date. After the successful filing of the VAT Return, a taxpayer will receive an e-mail from FTA confirming the submission of VAT return.

Final VAT Return

You have to submit a final VAT Return when you cancel your VAT registration.

The form is like any other form which you need to fill in according to the VAT law and FTA rules and regulations.